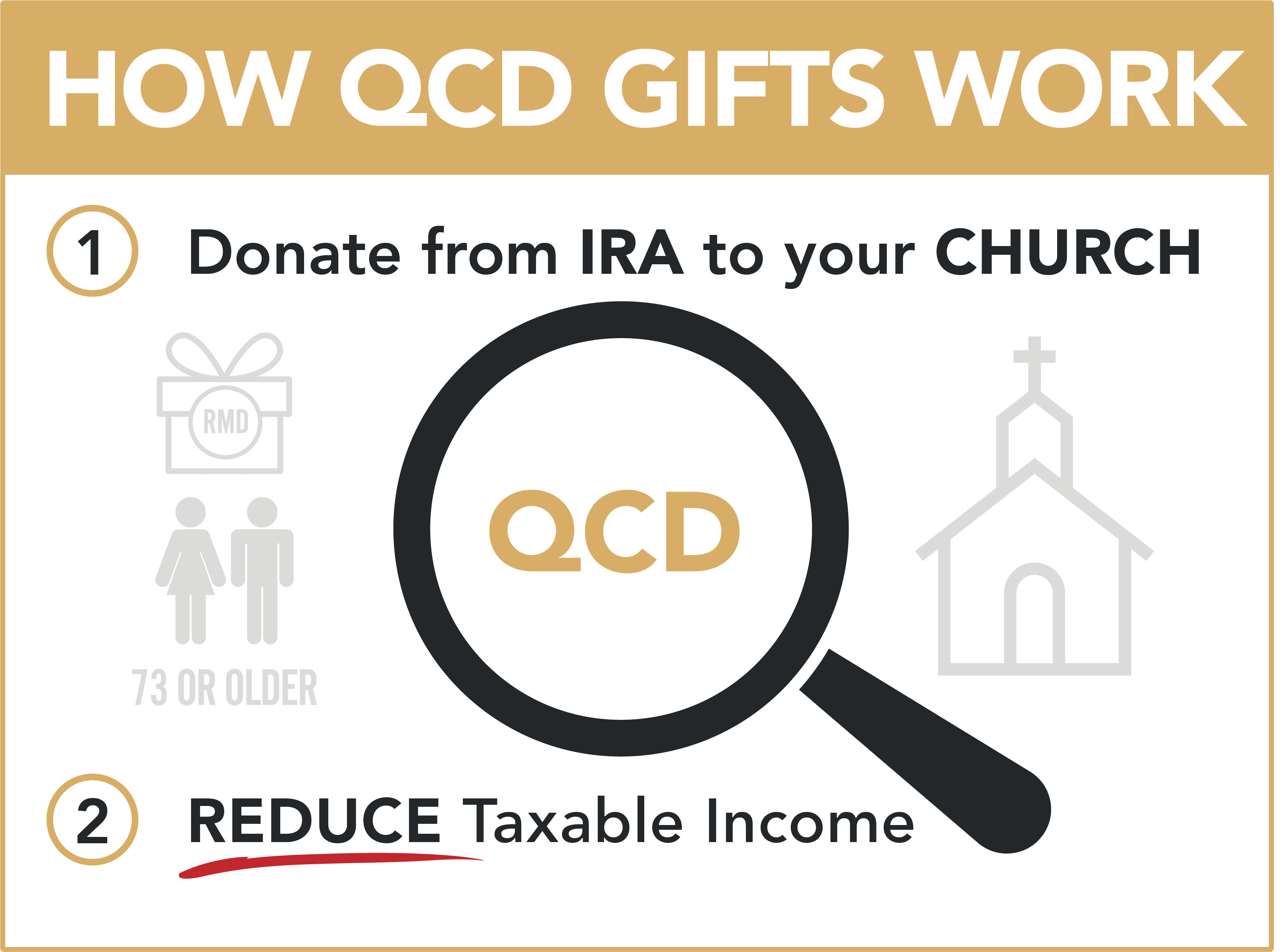

Give the RMD from your IRA

What is an RMD?

An RMD is a Required Minimum Distribution. If you are 73 and older then you are required to take RMDs from your tax deferred retirement accounts (i.e. IRA). It is the federal government’s opportunity to collect taxes on tax deferred accounts. When you receive an RMD, it becomes taxable income in the year in which you take it. The good news is that if you do not need all or part of your RMD, you can send a gift directly to ministry, rather than receiving the RMD yourself. When you do this, your gifted RMD becomes a QCD (Qualified Charitable Distribution) and is no longer counted as taxable income to you. If your retirement assets are currently in a 401(k) or 403(b) retirement account, you may first need to transfer assets to an IRA, then consider the RMD/QCD option.

How does an RMD gift work?

Individuals who are 73 or older can make a Qualified Charitable Distribution (QCD) — a tax-free charitable donation made directly from their IRA. QCDs are important because they represent a rare opportunity to make a tax-free donation in an age when far fewer taxpayers are eligible to itemize deductions on returns. QCDs provide a great way for donors to support ministries because the donor can reduce the annual taxable income generated by their RMD. Planned appropriately, a QCD can also support ministry and reduce taxes on an annual basis going forward.

Let us Help

If you are considering making a QCD from your IRA, please contact Pam Mills: pmills@gbfoundation.org (770) 452-8338

How the process works

-

1. Complete and Submit QCD Questionnaire

There are various factors to consider when making a QCD gift. The QCD Questionnaire is designed to l help you navigate those factors. Click here in order to correctly complete your QCD gift.

-

2. Meet with GBF staff member for gifting consultation

The Foundation’s professional staff is available to meet with you in person, over the phone, or via an online video call to go over your QCD Questionnaire and giving objectives. contactus@gbfoundation.org

-

3. Create a QCD Gift Instruction Form

The QCD Gift Instruction Form provides you with a printout of the basic information you need to begin the gift process with financial advisor or plan administrator.

-

4. Deliver the Form to Your Financial Advisor

Once you have completed the QCD Instruction Form, you will need to deliver it to your financial advisor or plan administrator. Your financial professional will then provide you with the appropriate paperwork to complete the gift. If you have any problems along the way, our staff is available to assist you in the process. Also, don’t forget to inform your tax preparer about your gift.

2022 Updates

* The SECURE (Setting Every Community UP for Retirement Enhancement) Act 2.0 was signed into law on December 29, 2022 and it raised the age requirement for being required to take an RMD (Required Minimum Distribution) from age 72 to age 73 in the year 2023. It also increases the age from 73 to 75 in the year 2033.